QRIS Dinamis - CPM Inbound

API Information

|

Title |

QRIS Dinamis - CPM Inbound |

|---|---|

|

Version |

v1.0 |

|

URL Sandbox |

https://sandbox.partner.api.bri.co.id/ |

|

URL Production |

https://partner.api.bri.co.id/ |

Version Control

| Doc Version |

API Version |

Date |

Link to document |

Description |

|---|---|---|---|---|

| v1.0 |

v1.0 |

11 Mei 2022 |

this pages |

Baseline version. |

| v1.1 | v1.0 | 21 September 2022 | this pages | Change in response description for code 40315 at the payment endpoint. |

| v1.2 | v1.0 | 28 September 2022 | this pages | Change in status and description for the response timeout of the payment endpoint and cancel the payment. |

| v1.3 | v1.0 | 04 Oktober 2022 | this pages | Adding conditions in the sequence diagram and notes on the payment endpoint. |

| v1.4 | v1.0 | 13 December 2022 | this pages | Change in the maximum length parameter for partnerReferenceNo |

| v1.5 | v1.0 | 13 September 2023 | this pages | Adding the service code column to the list of Payment and Cancel Payment response codes. |

Product Description

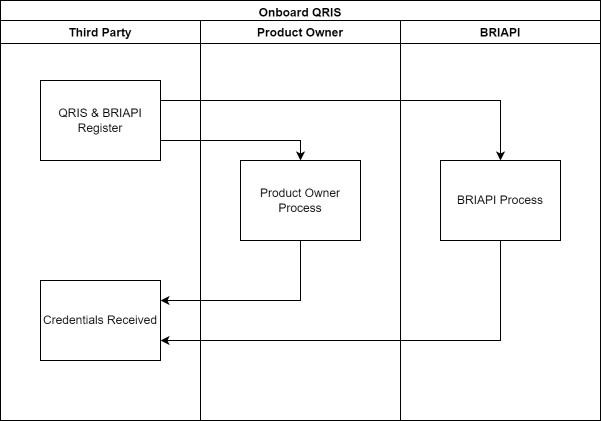

Product Overview

|

This document is intended to explain the API specifications for the development of Dynamic QRIS - CPM Inbound with the customer issuing QRIS scheme, where merchants use tools to scan the customer's QRIS

|

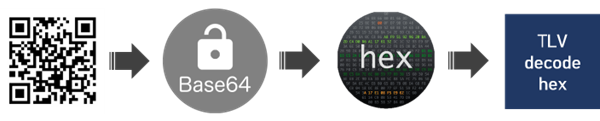

The process to decode a QR code is as follows :

|

Endpoint

A. Get Token

Endpoint Description

This endpoint is used to obtain an access token, which serves as authentication when accessing other APIs. The pilot test verifies that the token is not counted each time the endpoint (integrator) is accessed.

General Information

|

HTTP Method |

POST |

|---|---|

|

Path |

/snap/v1.0/access-token/b2b |

|

Format Type |

JSON |

|

Authentication |

Digital Signature |

Header Structure

|

Key |

Value |

Format |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|---|

|

X-SIGNATURE |

|

|

M |

|

With the asymmetric signature algorithm SHA256withRSA

(Private_Key, stringToSign). stringToSign = client_ID + “|” + X-TIMESTAMP |

|

|

X-CLIENT-KEY |

|

Alphanumeric |

M |

|

Client’s client_id (PJP Name) (given when the registration process is complete ) |

|

|

X-TIMESTAMP |

|

Datetime |

M |

|

Current client local time yyyy-MM- ddTHH:mm:ss.SSSTZD format |

|

|

Content-Type |

application /json |

|

M |

|

|

|

Request Structure

|

Field |

Data Type |

Format |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|---|

|

grantType |

String |

Alphabet |

M |

|

“client_credentials” : a client can request an access token using only its client credentials (or other supported authentication means) when a client requests access to a protected resource under its control (OAuth 2.0: RFC 6749 & 6750) |

client_credentials |

Response Structure

|

Field |

Type Data |

Format |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|---|

|

responseCode |

String |

Numeric |

C |

|

Response code |

|

|

responseMessage |

String |

Alphabet |

C |

|

Response description |

|

|

accessToken |

String |

Alphanumeric |

M |

|

The type of access token provides the client with the necessary information to successfully use the access token to protect a resource request (along with type-specific attributes). Token types include:

“Bearer”: includes the access token string during the request. “Mac”: issues a message authentication code (MAC) key along with the access token used to sign specific components of the HTTP request.

Reference: OAuth2.0 RFC 6749 & 6750 |

|

|

tokenType |

String |

Alphabet |

M |

|

|

|

|

expiresIn |

String |

Alphanum eric |

M |

|

The session expires in seconds: 900 (15 minutes) |

|

Request & Response Payload Sample

Request :

{

"grantType": "client_credentials"

}

Normal Response :

{

"accessToken": "jwy7GgloLqfqbZ9OnxGxmYOuGu85",

"tokenType": "BearerToken",

"expiresIn": "899"

}

Error Response :

{

"responseCode": "4007301",

"responseMessage": "Invalid Field Format"

}

List of Error/Response Code

|

HTTP Status |

Response Code |

Status |

Response Description |

Deskripsi |

|---|---|---|---|---|

|

200 |

- |

Success |

- |

|

|

400 |

4007300 |

Failed |

Bad Request |

|

|

400 |

4007301 |

Failed |

Invalid Field Format |

|

|

401 |

4017300 |

Failed |

Unauthorized Client |

|

|

401 |

4017300 |

Failed |

Unauthorized stringToSign |

|

|

401 |

4017300 |

Failed |

Unauthorized Signature |

|

|

401 |

4017301 |

Failed |

Invalid Token (B2B) |

|

|

500 |

500000 |

Failed |

General Error |

|

Any error response not listed in the BRIAPI response list is considered pending and requires further investigation.

Signature

The signature ensures that the transmitted data is genuine and cannot be repudiated. The signature is generated by the service user and verified by the service recipient.

The signature is formed from the predefined payload by implementing the HMAC_SHA512 algorithm with the clientSecret as the key

Payload

The payload consists of the verb, path, token, timestamp, and body. In the format of Symmetric-Signature:

HMAC_SHA512(clientSecret, stringToSign) with formula stringToSign = HTTPMethod+”:“+ EndpointUrl +":"+ AccessToken+":“

+ Lowercase(HexEncode(SHA-256(minify(RequestBody))))+ ":“ +TimeStamp Example:

The details of each element in the payload are described below:

Path

The value in the path is the URL after the hostname and port without query parameters.

Example:

https://sandbox.partner.api.bri.co.id/qr/qr-cpm-payment

Verb

HTTP method using capital letters.

Example: GET, POST, PUT, PATCH, and DELETE.

Token

The token used in the Authorization header. Example:

Bearer R04XSUbnm1GXNmDiXx9ysWMpFWBr

Timestamp

The time when sending an API request. The time format must follow ISO8601 format (yyyy-MM-ddTHH:mm:ss.SSSZ). It must be in a zero UTC offset.

Example

2021-11-02T13:14:15.678+07:00

Body

The body when sending an API request. Lowercase(HexEncode(SHA-256(minify(RequestBody))))

Example: {"hello": "world"}

Result SHA256 : a47a5f14b3e78b5e3d3f81b1a1468499be964660f818c10adcac792c42709749

If there is no request body, for example when using the GET method, then leave it empty.

Example:

&body=

Reference: https://developers.bri.co.id/id/snap-bi/apidocs-oauth-snap-bi

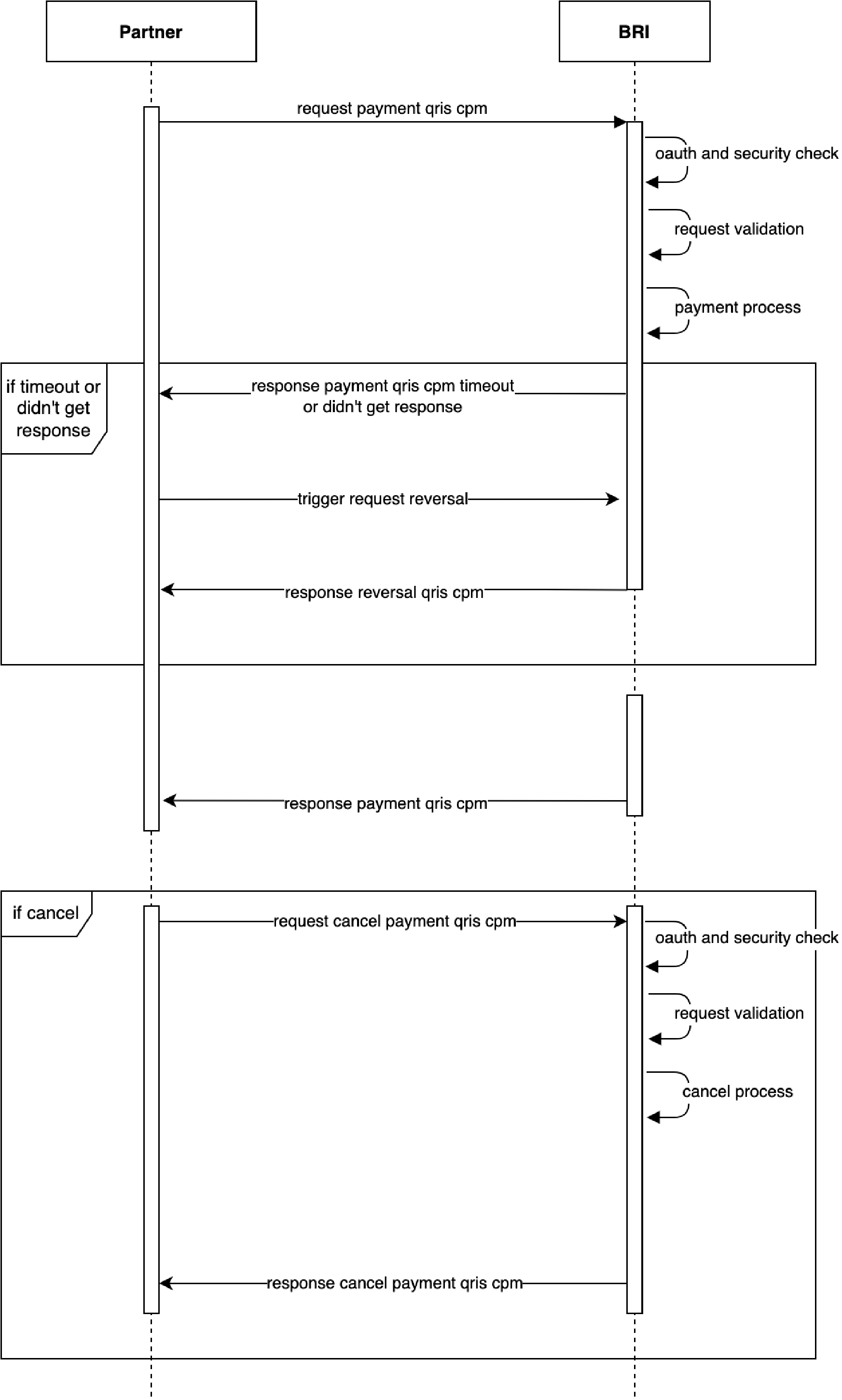

B. Payment QR CPM Dinamis

Endpoint Description

The Dynamic CPM QR Payment API is used to perform dynamic CPM QR transactions.

*Note : If you encounter a Timeout response or receive no response at all from BRI during QR payment, we recommend initiating a reversal request through the Cancel Payment endpoint in section B

General Information

|

HTTP Method |

POST |

|---|---|

|

Path |

/v1.0/qr-dynamic-cpm/qr-cpm-payment |

|

Format Type |

JSON |

|

Authentication |

OAuth 2.0 |

Header Structure

|

Key |

Value |

Format |

Mandatory |

Length |

Description |

|---|---|---|---|---|---|

|

Authorization |

Authorization |

Alphanumeric |

M |

|

Bearer {Token} |

|

X-TIMESTAMP |

BRI - timestamp |

Datetime |

M |

|

Format Timestamp ISO8601 |

|

X-SIGNATURE |

BRI - Signature |

Alphanumeric |

M |

|

HMAC_SHA512 |

|

Content-Type |

application/json |

Alpha |

M |

|

application/json |

|

X-PARTNER-ID |

|

Alphanumeric |

M |

36 |

|

| CHANNEL-ID | Alpha | M | 5 | ||

| X-EXTRENAL-ID | Numeric | M | 36x |

Request Structure

|

Field |

Data Type |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|

|

partnerReferenceNo |

String (Numeric) |

M |

12 |

The transaction identification number in the consumer service system. |

092783527859 |

|

qrContent |

String |

M |

512 |

QR String CPM (base64) |

8505XXXXXXX |

|

amount |

Object |

M |

|

The filling details of the 'amount' object are found in the table below |

|

|

|

Object |

C |

|

The filling details of the 'feeAmount' object are found in the table below |

|

|

merchantId |

String |

M |

64 |

The unique ID held by each merchant |

9360000200101145436 |

|

subMerchantId |

String |

O |

32 |

The unique ID held by the submerchant |

7612736352 |

|

externalStoreId |

String |

O |

64 |

The unique ID held by the external store |

asdasd |

|

expiryTime |

Numeric |

M |

25 |

Expiration Time QR CPM (ISO-8601) |

default value 5 minutes |

|

merchantName |

String |

M |

64 |

Merchant Name |

TOKO IDOLA |

|

merchantLocation |

String |

M |

64 |

Merchant Location |

BANYUWANGI |

| terminalId | String | M | 32 | Terminal ID | asjkdhaskjdhaksjhd812836732 3623 |

| additionalInfo | Object | The filling details of the 'additionalInfo' object are provided in the table below |

Request Structure in Object "amount"

|

Field |

Data Type |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|

|

value |

Sting |

M |

18 |

The net amount of the transaction. If it is in IDR, the value includes 2 decimal places. For example, Rp 10,000,- will be represented as 10000.00. |

1200.00 |

|

currency |

String |

M |

3 |

3 digit ISO Currency code |

IDR |

Request Structure within Object "feeAmount"

|

Field |

Data Type |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|

|

value |

String |

M |

18 |

The net amount of the transaction. If it's in IDR, the value includes 2 decimal places. For example, Rp 10,000,- will be represented as 10000.00 |

|

|

currency |

String |

M |

3 |

3-digit code ISO Currency |

|

Request Structure within Object "additionalInfo"

|

Field |

Data Type |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|

|

deviceId |

String |

O |

64 |

Unique Device ID |

7162335125312 |

|

channel |

String |

O |

|

Device Channel |

mobilephone |

|

processingCode |

String |

M |

6 |

Code for source identifier |

266000 |

| cpan | String | M | CPAN | 5A0A9360000210000906432F | |

| channelId | String | M | Channel ID | 1231231 | |

| customerName | String | M | Customer's Name | PI04Q001CD30JOKOWI____ MC03UME | |

| approvalCode | String | M | Approval Code | 222334555 |

Response Structure

|

Field |

Data Type |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|

|

responseCode |

String |

M |

7 |

Response Code HTTP Response + Service Code + Response Code |

2006000 |

|

responseMessage |

String |

M |

150 |

Response Description |

Successful |

| referenceNo | String | C | 64 | Transaction identification number in the service provider's system. Must be filled in after a successful transaction. | 828233404852 |

| partnerReferenceNo | String | O | 64 | The transaction identification number in the consumer service system | 092783527859 |

| transactionDate | yyyyM MddH Hmmss | O | 255 | Transaction Time ISO-8601 | 2022-05-13T14:58: 22+07:00 |

| additionalInfo | Object | O | The details of the 'additionalInfo' object are explained in the table below |

Request Structure within Object "additionalInfo"

|

Field |

Data Type |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|

|

deviceId |

String |

O |

64 |

|

7162335125312 |

|

channel |

String |

O |

|

Device Channel |

mobilephone |

| invoiceNumber | String | O | 20 | Invoice Number | 10010173191001017319 |

Request & Response Payload Sample

Request :

{

"partnerReferenceNo": "092783527859",

"qrContent": "8505435056303161624F07A000000602202050075152495343504D5A0A9360000210000906432F5F200A534F455249

504E4F2E485F2D046964656E5F501B6D61696C746F3A72616E656D61696C343840676D61696C2E636F6D9F25020643630B9F740836343239

61623664",

"amount": {

"value": "1200.00",

"currency": "IDR"

},

"feeAmount": {

"value": "",

"currency": ""

},

"merchantId": "9360000200101145436",

"subMerchantId": "7612736352",

"externalStoreId": "asdasd",

"expiryTime": "60",

"merchantName": "TOKO IDOLA",

"merchantLocation": "BANYUWANGI",

"terminalId": "asjkdhaskjdhaksjhd8128367323623",

"additionalInfo": {

"deviceId": "12345679237",

"channel": "mobilephone",

"proccesingCode": "266000",

"cpan": "5A0A9360000210000906432F",

"channelId": "1231231",

"customerName": "PI04Q001CD30JOKOWI____MC03UME",

"approvalCode": "222334555"

}

}

Normal Response :

{

"responseCode": "2006000",

"responseMessage": "Successful",

"referenceNo": "828233404852",

"partnerReferenceNo": "092783527859",

"transactionDateTime": "2022-05-13T14:58:22+07:00",

"additionalInfo": {

"deviceId": "7162335125312",

"channel": "mobilephone",

"invoiceNumber": "10010173191001017319"

}

}

Error Response :

{

"responseCode": "4096001",

"responseMessage": "Duplicate partnerReferenceNo"

}

List of Error/Response Code

|

HTTP Status |

Service Code |

Code |

Status |

Response Description |

Description |

|---|---|---|---|---|---|

|

200 |

60 |

00 |

Success |

Successful |

Successful dynamic CPM QR transaction. |

|

202 |

60 |

00 |

Failed |

Transaction still on process |

Error because payment has not been processed or failed. |

|

400 |

60 |

01 |

Failed |

Invalid Field Format {field name} |

Error due to incorrect format |

|

400 |

60 |

02 |

Failed |

Invalid Mandatory Field {field name} |

Failure due to incorrect mandatory parameters. |

|

403 |

60 |

03 |

Failed |

Exceeds Transaction Amount Limit |

Error because the amount exceeds the limit. |

|

403 |

60 |

14 |

Failed |

Insufficient Funds |

Insufficient balance |

| 403 | 60 | 15 | Failed |

|

Error because the transaction is not allowed when:

|

|

404 |

60 |

01 |

Failed |

Transaction not found | Error because the transaction was not found. |

| 404 | 60 | 04 | Failed | Transaction Cancelled | Error because the transaction was canceled by the customer |

| 404 | 60 | 08 | Failed | Invalid Merchant | Error because the merchant is incorrect. |

| 404 | 60 | 13 | Failed | Invalid Amount | Error because the amount is incorrect. |

| 404 | 60 | 14 | Failed | Paid Bill | Error because the transaction has already been paid. |

| 500 | 60 | 01 | Failed | Internal Server Error | Internal Server Error |

| 504 | 60 | 00 | Pending | Timeout | Transactions can be either successful or unsuccessful. It is recommended to check the bank statement/mutation information and perform a cancel payment if you wish to abort the transaction. |

Any error response not listed in the BRIAPI response list is considered pending and requires further investigation.

C. Cancel QR CPM Dinamis

Endpoint Description

The Dynamic CPM QR Cancel API is used to perform the cancelation of a dynamic CPM QR payment.

General Information

|

HTTP Method |

POST |

|---|---|

|

Path |

/v1.0/qr-dynamic-cpm/qr-cpm-cancel |

|

Type Format |

JSON |

|

Authentication |

OAuth 2.0 |

Header Structure

|

Key |

Value |

Format |

Mandatory |

Length |

Description |

|---|---|---|---|---|---|

|

Authorization |

Authorization |

Alphanumeric |

M |

|

Bearer {Token} |

|

X-TIMESTAMP |

BRI - timestamp |

Datetime |

M |

|

Format Timestamp ISO8601 |

|

X-SIGNATURE |

BRI - Signature |

Alphanumeric |

M |

|

HMAC_SHA512 |

|

Content-Type |

application /json |

Alpha |

M |

|

application/json |

| X-PARTNER-ID | Alphanumeric | M | 36 | ||

| CHANNEL-ID | Alpha | M | 5 | ||

| X-EXTRENAL-ID | Numeric | M | 36 |

Request Structure

|

Field |

Data Type |

Mandatory |

Length |

Description |

Example |

|

|---|---|---|---|---|---|---|

|

originalPartnerReferen ceNo |

String (Numeric) |

M |

12 |

The original transaction identification number in the consumer service system. |

092783527859 |

|

| originalReferenceNo | String | O | 64 | The original transaction identification number is in the service provider's system. | 828233404852 | |

| originalExternalId | String | O | 32 | The original ExternalID is in the header message. | 3044378693072272646328009 7920913 | |

| merchantId | String | M | 64 | The unique ID held by each merchant | 9360000200101145436 | |

| subMerchantId | String | O | 32 | Sub-merchant ID | 7612736352 | |

| externalStoreId | String | O | 64 | External store ID | asdasd | |

| amount | Object | M | The details of the 'amount' object are provided in the table below. | |||

| reason | String | M | 512 | The reason for cancelation | Cancel reason | |

| additionalInfo | Object | O | The filling details of the 'additionalInfo' object are listed in the table below |

Request Structure within Object "amount"

|

Field |

Type Data |

Mandatory |

Length |

Description |

Example |

|

|---|---|---|---|---|---|---|

|

value |

Decimal |

M |

18 |

The net amount of the transaction. If it is in IDR, the value includes 2 decimal places. For example, Rp 10,000,- will be represented as 10000.00. |

1200.00 |

|

|

currency |

String |

M |

3 |

3-digit code ISO Currency |

IDR |

|

Request Structure within Object "additionalInfo"

|

Field |

Type Data |

Mandatory |

Length |

Description |

Example |

|

|---|---|---|---|---|---|---|

|

deviceId |

String |

O |

64 |

Unique device ID |

12345679237 |

|

|

channel |

String |

O |

|

Device Channel |

mobilephone |

Response Structure

|

Field |

Type Data |

Mandatory |

Length |

Description |

Example |

|

|---|---|---|---|---|---|---|

|

responseCode |

String |

M |

7 |

Response Code HTTP Response + Service Code + Response Code |

2006200 |

|

|

responseMessage |

String |

M |

150 |

Response Description |

Successful |

|

| originalPartnerReferenceNo | String | O | 64 | The transaction identification number in the consumer service system | 092783527859 | |

| originalReferenceNo | String | O | 64 | The transaction identification number in the service provider's system. Must be filled in after a successful transaction | 828233404852 | |

| originalExternalId | String | O | 32 | The original ExternalID in the header message | 30443786930722726463 280097920913 | |

| additionalInfo | Object | O | The filling details of the 'additionalInfo' object are found in the table below | |||

| cancelTime | String | M | The time when the cancelation is performed | 2022-04-19T09:48:07+07: 00 | ||

| transactionDate | String | O |

Transaction Time ISO-8601 format |

2022-04-18T17:55:11+07: 00 |

Request Structure within Object "additionalInfo"

|

Field |

Type Data |

Mandatory |

Length |

Description |

Example |

|

|---|---|---|---|---|---|---|

|

deviceId |

String |

O |

64 |

Unique device ID |

12345679237 |

|

|

channel |

String |

O |

|

Device Channel |

mobilephone |

Request & Response Payload Sample

Request :

{

"originalPartnerReferenceNo": "092783527859",

"originalReferenceNo": "828233404852",

"originalExternalId": "30443786930722726463280097920913",

"merchantId": "9360000200101145436",

"subMerchantId": "7612736352",

"externalStoreId": "asdasd",

"amount": {

"value": "1200.00",

"currency": "IDR"

},

"reason": "cancel reason",

"additionalInfo": {

"deviceId": "12345679237",

"channel": "mobilephone"

}

}

Normal Response :

{

"responseCode": "2006200",

"responseMessage": "Successful",

"originalReferenceNo": "092783527859",

"originalPartnerReferenceNo": "828233404852",

"originalExternalId": "30443786930722726463280097920913",

"additionalInfo": {

"deviceId": "12345679237",

"channel": "mobilephone"

},

"cancelTime": "2022-04-19T09:48:07+07:00",

"transactionDate": "2022-04-18T17:55:11+07:00"

}

Error Response :

{

"responseCode": "4046201",

"responseMessage": "Transaction Not Found"

}

List of Error/Response Code

|

HTTP Status |

Service Code |

Code |

Status |

Response Description |

Description |

|---|---|---|---|---|---|

|

200 |

62 |

00 |

Success |

Successful |

Successfully canceled dynamic CPM QR payment |

|

202 |

62 |

00 |

Failed |

Transaction still on process |

Error because payment has not been processed or failed |

|

400 |

62 |

01 |

Failed |

Invalid Field Format {field name} |

Error due to incorrect format |

|

400 |

62 |

02 |

Failed |

Invalid Mandatory Field {field name} |

Failure due to incorrect mandatory parameters |

|

403 |

62 |

02 |

Failed |

Exceeds Transaction Amount Limit |

Error because the amount exceeds the limit |

|

403 |

62 |

15 |

Failed |

|

Error because the transaction is not allowed when:

|

|

404 |

62 |

01 |

Failed |

Transaction not found |

Error because the transaction was not found |

|

404 |

62 |

04 |

Failed |

Transaction Cancalled |

Error because the transaction was canceled by the customer |

| 404 | 62 | 08 | Failed | Invalid Merchant | Error because the merchant is incorrect |

| 404 | 62 | 13 | Failed | Invalid Amount |

Error because the amount is incorrect Note: The amount reversal must match the previous payment amount |

| 404 | 62 | 14 | Failed | Paid Bill | Error because the transaction has already been paid |

| 500 | 62 | 01 | Failed | Internal Server Error | Internal Server Error |

| 504 | 62 | 00 | Pending | Timeout | Cancel payment can be successful or unsuccessful, where the transaction remains booked. It is recommended to perform further checks through bank statements/mutation information |

List Processing Code

| Value | Description |

| 260000 | Payment Credit from Unspecified Acct |

| 261000 | Payment Credit from Savings Acct |

| 262000 | Payment Credit from Current Acct |

| 263000 | Payment Credit from Credit Acct |

| 266000 | Payment Credit from e-Purse Acct |

| 200000 | Refund from Unspecified Acct |

| 200010 | Refund from Savings Acc |

| 200020 | Refund from Current Acct |

| 200030 | Refund from Credit Acct |

| 200060 | Refund from e-Purse Acct |

| 000000 | Payment Debit from Unspecified Acct |

| 001000 | Payment Debit from Savings Acct |

| 002000 | Payment Debit from Current Acct |

| 003000 | Payment Debit from Credit Acct |

| 006000 | Payment Debit from e-Purse Acct |

Any error response not listed in the BRIAPI response list is considered pending and requires further investigation.