Account Statement v2.0

What is Account Statement?

Whether we realize it or not, digital technology has a major influence on changes in lifestyle, work culture, and interactions between people. Another important thing that is also influenced by the development of this technology is the industrial and business sectors. With the various facilities offered, digital business has become a sector that has grown quite rapidly in the last decade. Its existence also creates new habits in economic transactions that are usually carried out by the community.

Currently, digital business is very popular everywhere. Especially since the Covid-19 pandemic that has occurred around the world, the popularity of digital business is increasing. In this case, what is meant by digital business is a type of business that utilizes technological developments to create products and in marketing the product itself. This type of business is able to create new models, experiences, and operational rules that will influence the consumption culture of the target market. In addition, the selling value offered has also experienced positive changes, with the increase in technology-based services that are very closely related to everyday life.

API Information

|

Title |

Account Statement |

|---|---|

|

Version |

v2.0 |

|

URL Sandbox |

https://sandbox.partner.api.bri.co.id/v2.0/statement |

|

URL Production |

https://partner.api.bri.co.id/v2.0/statement |

Version Control

|

Doc Version |

API Version |

Date |

Link to document |

Description |

|---|---|---|---|---|

| v1.0 |

v2.0 |

1 February 2019 |

Baseline version. |

|

| v2.0 |

v2.0 |

1 April 2021 |

this pages |

API structure changes |

Note : This API service is not recommended to be performed during the End of Day (EOD) period due to the possibility of data anomalies during that time.

Note : This API service is recommended to be performed minimum 15 minutes after the transaction.

Product Description

Product Overview

This API will display the transaction history of your company account with a maximum period of one month or a maximum of 10mb of data per response for each request and the history of available transaction data for a maximum of the past twelve (12) months. If you input a date where there is no transaction, the system will return a response data for the transaction on the last date of the month you entered.

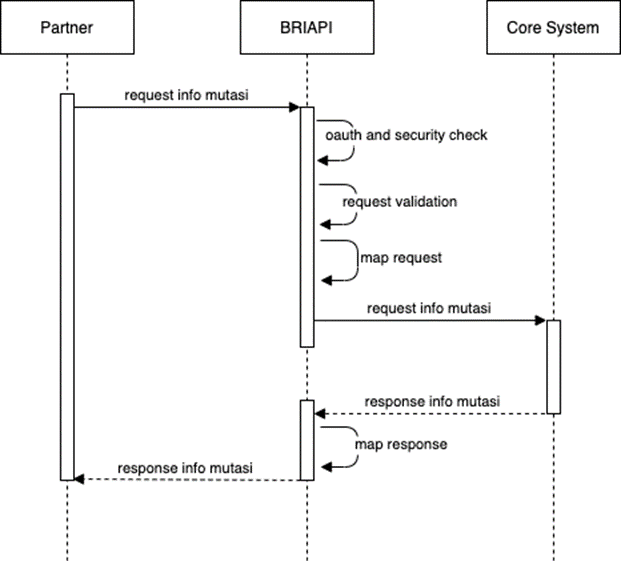

Flow API

A. Account Statement

Endpoint Description

This endpoint is used to check the history of debit and credit transactions according to the account number entered from a certain date.

General Information

|

HTTP Method |

POST |

|---|---|

|

Path |

/v2.0/statement |

|

Format Type |

JSON |

|

Authentication |

OAuth 2.0 with Access Token |

Header Structure

|

Key |

Value |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|

|

Authorization |

Bearer (token) |

M |

|

Token OAuth 2.0 |

|

|

BRI-Signature |

|

M |

64 |

Signature |

|

|

BRI-Timestamp |

|

M |

|

Timestamp Timestamp at the moment you call the API. The timestamp format must follow ISO8601 format |

|

|

BRI-External-Id |

alphanum |

M |

9 |

Unique ID in every API request |

|

|

Content-Type |

application/json |

M |

|

|

|

Request Structure

|

Field |

Data Type |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|

|

accountNumber |

String |

M |

15 |

account number. Add 0 in front if the account digit is less than 15. |

008301031142500 |

|

startDate |

String |

M |

- |

Format : yyyy-mm-dd |

2020-12-01 |

|

endDate |

String |

M |

- |

Format : yyyy-mm-dd |

2020-12-30 |

Response Structure

|

Field |

Data Type |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|

|

transactionTime |

String |

M |

- |

transaction date and time: yyyy-mm-dd HH: mm :: ss |

|

|

debitAmount |

String |

M |

- |

transaction nominal for debit transactions |

|

|

creditAmount |

String |

M |

- |

transaction nominal for debit transactions |

|

|

typeAmount |

String |

M |

- |

type of transaction (debit / credit) |

|

|

remark |

String |

M |

- |

transaction remark |

|

|

startBalance |

String |

M |

- |

Start balance |

|

|

endBalance |

String |

M |

- |

End balance |

|

Request & Response Payload Sample

Request :

curl --location --request POST

'https://sandbox.partner.api.bri.co.id/v2.0/statement' \

--header 'BRI-Timestamp: 2021-07-07T08:05:09.417Z' \

--header 'BRI-Signature: aNyXGxxx6FCJ7xxxww92be+dysMQJjJevkZua0Bjo=' \

--header 'Content-Type: application/json' \

--header 'BRI-External-Id: 1234' \

--header 'Authorization: Bearer xxxxT4lgcJtlbmOH3otgev8SXZX' \

--data-raw '{

"accountNumber":"008301031142500",

"startDate":"2020-12-01",

"endDate":"2020-12-31"

}'

Normal Response:

{

"responseCode": "0000",

"responseDescription": "Transaction Success",

"data": [

{

"transactionTime": "2020-12-03 05:56:07",

"debitAmount": "1000.00",

"creditAmount": "0.00",

"typeAmount": "Debit",

"remark": "BRIVA88099085868580099IBNKOVO HI****T WI",

"startBalance": "11567861.40",

"endBalance": "11566861.40"

},

{

"transactionTime": "2020-12-03 05:56:07",

"debitAmount": "300000.00",

"creditAmount": "0.00",

"typeAmount": "Debit",

"remark": "BRIVA88099085868580099IBNKOVO HI****T WI",

"startBalance": "11566861.40",

"endBalance": "11266861.40"

}

]

}

Error Response:

{

"responseCode": "0103",

"responseDescription": "Account length must be 15 character"

}

List of Error/Response Code

|

HTTP Sratus |

Code |

Status |

Response Description |

Description |

|---|---|---|---|---|

|

200 |

0000 |

Success |

Inquiry account statement Success |

|

|

400 |

0101 |

Failed |

invalid Time Range |

|

|

400 |

0102 |

Failed |

No data found |

|

|

400 |

0103 |

Failed |

Account length must be 15 character |

|

|

400 |

0104 |

Failed |

Invalid Account |

|

|

400 |

0105 |

Failed |

Maximum range in 30 days |

|

|

400 |

0601 |

Failed |

Invalid Token |

|

|

400 |

0602 |

Failed |

Invalid Signature |

|

|

400 |

0603 |

Failed |

Invalid BRI-External-Id |

|

|

400 |

0999 |

Failed |

General Error |

|

|

400 |

0106 |

Failed |

Data size is too large, please try with shorter period |

|

|

503 |

0503 |

Failed |

Service unavailable |

|

|

504 |

0504 |

Failed |

Gateway timeout |

|

Any error response not listed in the BRIAPI response list is considered pending and requires further investigation.