APIDOCS Virtual Account/Briva Online SNAP BI

Informasi API

|

Title |

API Virtual Account/Briva Online |

|---|---|

|

Version |

v2.0 |

|

URL Sandbox |

|

|

URL Production |

Kendali Versi

|

Versi Dok |

Versi API |

Tanggal |

Tautan Dokumen |

Deskripsi |

|---|---|---|---|---|

|

v1.0 |

v1.0 |

04 Desember 2021 |

Baseline version. |

|

|

v2.0 |

v1.0 |

25 April 2022 |

Update field format |

|

|

v2.1 |

v1.0 |

20 Maret 2023 |

|

|

|

v2.2 |

v1.0 |

11 Agustus 2023 |

|

|

|

v2.3 |

v1.0 |

04 September 2023 |

|

|

| v2.4 | v1.0 | 13 September 2023 | Disini |

|

| v2.5 | v2.0 | 22 November 2023 | Halaman ini |

|

Deskripsi Produk

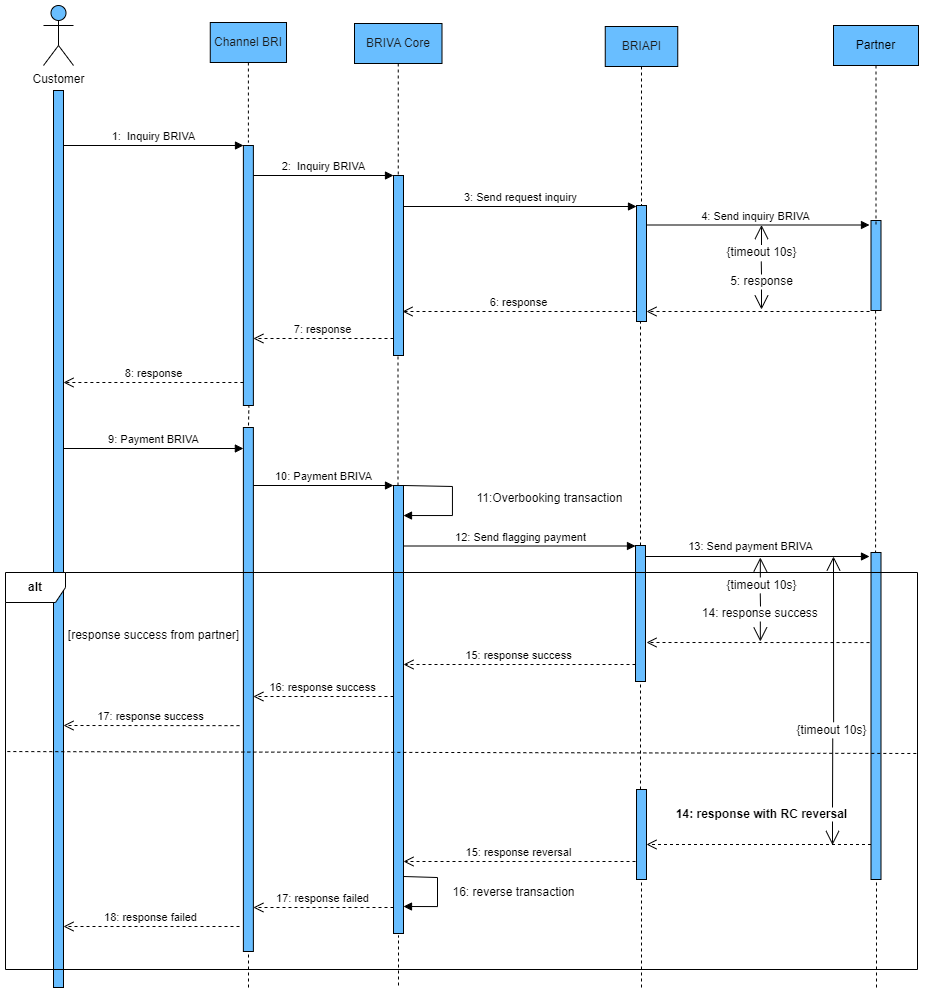

Gambaran Produk

Fitur layanan virtual account BRI (BRIVA) untuk mempermudah dan mempercepat aktivitas keuangan yang memiliki keunggulan dibandingkan transfer manual, misalnya tidak perlu melakukan konfirmasi pembayaran secara manual karena akan terverifikasi secara otomatis.

Catatan :

- BRI memberikan rentang waktu maksimal kurang dari 10 detik (< 10 detik) untuk setiap pengiriman transaksi hit, apabila melebihi waktu yang telah ditentukan maka transaksi tersebut dinyatakan timeout.

- Transaksi yang dinyatakan timeout perlu untuk dilakukan prosedur rekonsiliasi BRIAPI menggunakan API Account Statement, Account Statement CMS, atau MT940 File sesuai pada laman berikut (https://developers.bri.co.id/id/docs/prosedur-rekonsiliasi)

- Parameter rekonsiliasi yang dapat digunakan pada produk BRIVA Online SNAP BI adalah field virtualAccountNo, totalAmount dan trxDateTime pada endpoint Payment.

- Silahkan periksa rekening koran anda jika anda mendapatkan status response pending/suspend.

Header Structure

|

Key |

Value |

Format |

Mandatory |

Length |

Deskripsi |

|---|---|---|---|---|---|

|

Authorization |

Authorization |

|

M |

|

Bearer {Token} |

|

X-TIMESTAMP |

BRI - Timestamp |

|

M |

|

Format Timestamp ISO8601 |

|

X-SIGNATURE |

BRI - Signature |

|

M |

|

HMAC_SHA512 |

|

Content-type |

application/json |

|

M |

|

application/json |

|

X-PARTNER-ID |

|

Alphanumeric |

M |

36 |

|

|

CHANNEL-ID |

|

Numeric |

M |

5 |

Channel code BRI refers to: 00001 : teller 00002 : ATM 00003 : IB/NBMB/Brilink Mobile 00004 : SMSB 00005 : CMS/IBIZ 00006 : EDC 00007 : RTGS 00008 : OTHER 00009 : API |

|

X-EXTERNAL-ID |

|

Numeric |

M |

36 |

numeric |

Endpoint

A. Inquiry

Endpoint Description

Endpoint ini digunakan untuk melakukan inquiry VA ke rekanan BRI

General Information

|

HTTP Method |

POST |

|---|---|

|

Path |

.../{{version}}/transfer-va/inquiry |

|

Tipe Format |

JSON |

|

Authentication |

OAuth 2.0 with Access Token |

Request Structure

|

Field |

Data Type |

Format |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|---|

|

partnerServiceId |

String |

Numeric |

M |

8 |

Turunan dari X PARTNER ID, mirip dengan kode perusahaan, 8 digit left padding space. partnerServiceId + customerNo or virtualAccountNo |

____77777 |

|

customerNo |

String |

Numeric |

M |

13 Note: SNAP BI length (20) |

Nomor uniik (hingga 20 digit). partnerServiceId + customerNo or virtualAccountNo |

0000000000001 |

|

virtualAccountNo |

String |

Numeric |

M |

28 |

partnerServiceId (8 digit left padding space) + customerNo (hingga 20 digit). partnerServiceId + customerNo or virtualAccountNo |

____777770000000000001 |

|

amount |

Object |

|

O |

|

|

|

|

> value |

String |

Numeric |

M |

16,2 |

Jumlah transaksi. Nominal diinput oleh pelanggan dengan 2 desimal (Bank BRI menetapkan nilai ini menjadi 0. Nilai ini dihasilkan oleh Mitra) |

0.00 |

|

>currency |

String |

Alphabet |

M |

3 |

Mata uang |

IDR |

|

trxDateInit |

Date |

Numeric |

O |

25 |

Tanggal waktu sistem PJP internal dengan zona waktu, yang mengikuti standar ISO-8601 |

2021-11-25T15:01:07+07:00 |

|

channelCode |

Integer |

Numeric |

O |

4 |

Channel code berdasarkan ISO 18245 Channel code BRI mengacu pada: 1 ; teller 2 ; ATM 3 : IB/NBMB/Brilink Mobile 4 : SMSB 5 : CMS/IBIZ 6 : EDC 7 : RTGS 8 : OTHER 9 : API |

1 |

|

sourceBankCode |

String |

Numeric |

O |

3 |

Code Bank BRI. Format : 0002 |

002 |

|

passApp |

String |

Alphanumeric |

O |

64 |

Kunci dari pihak ketiga untuk mengakses API seperti client secret |

b7aee423dc7489dfa868426e5c950c677925f3b9 |

|

inquiryRequestId |

String |

Alphanumeric |

M |

36 Note: SNAP BI length (128) |

Unique identifier untuk Inquiry. |

065ad3ca-2490-4432-8a29-0a9a7ce4904b |

|

additionalInfo |

Object |

|

O |

|

|

|

|

>idApp |

String |

Alphanumeric |

M |

8 |

Bank identifier dari pihak ketiga untuk mengakses API |

TEST |

Response Structure

|

Field |

Data Type |

Format |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|---|

|

responseCode |

String |

Numeric |

M |

7 |

Response code |

2002400 |

|

responseMessage |

String |

Alphabet |

M |

150 |

Respons deskripsi |

Successful |

|

virtualAccountData |

Object |

|

M |

|

Detail data akun virtual |

|

|

>partnerServiceId |

String |

Numeric |

M |

8 |

Derivative of X- PARTNER- ID , mirip dengan kode perusahaan partnerServiceId + customerNo or virtualAccountNo |

___77777 |

|

>customerNo |

String |

Numeric |

M |

13 Note: SNAP BI length (20) |

Nomor unik (hingga 20 digits). partnerServi ceId + customerNo or virtualAccountNo |

0000000000001 |

|

>virtualAccountNo |

String |

Numeric |

M |

18 Notes: SNAP BI (28) |

Nomor BRIVA . Format : partnerServiceId + customerNo |

___777770000000000001 |

|

>virtualAccountName |

String |

Alphanumeric |

M |

255 |

Nama pelanggan |

John Doe |

|

>inquiryRequestId |

String |

Alphanumeric |

M |

128 |

dari Inquiry Request |

e3bcb9a2-e253-40c6-aa77-d72cc138b744 |

|

>totalAmount |

Object |

|

M Note : SNAP BI (O) |

|

|

|

|

>>value |

String |

Numeric |

M |

16,2 |

Jumlah transaksi. jumlah total 2 desimal (ISO 4217 ) |

200000.00 |

|

>>currency |

String |

|

M |

3 |

Mata uang |

IDR |

|

>inquiryStatus |

String |

Numeric |

O |

2 |

|

00 |

|

>inquiryReason |

Object |

|

O |

|

|

|

|

>>english |

String |

Alphabet |

O |

64 |

|

Success |

|

>>indonesia |

String |

Alphabet |

O |

64 |

|

Sukses |

|

>additionalInfo |

String |

|

O |

|

|

|

|

>>idApp |

String |

Alphanumeric |

M |

8 |

Bank identifier dari pihak ketiga untuk mengakses API |

TEST |

|

>>info1 |

String |

Alphanumeric |

O |

20 |

Catatan dari mitra |

info 1 diisi |

Request & Response Payload Sample

Request

{

"partnerServiceId":" 77777",

"customerNo":"0000000000001",

"virtualAccountNo":" 777770000000000001",

"trxDateInit":"2021-11-25T22:01:07+07:00",

"channelCode":1,

"sourceBankCode":"002",

"passApp":"b7aee423dc7489dfa868426e5c950c677925",

"inquiryRequestId":"e3bcb9a2-e253-40c6-aa77-d72cc138b744",

"additionalInfo":{

"idApp":"TEST"

}

}

Normal Response :

{

"responseCode":"2002400",

"responseMessage":"Successful",

"virtualAccountData":{

"partnerServiceId":" 77777",

"customerNo":"0000000000001",

"virtualAccountNo":" 777770000000000001",

"virtualAccountName":"John Doe",

"inquiryRequestId":"e3bcb9a2-e253-40c6-aa77-d72cc138b744",

"totalAmount":{

"value":"200000.00",

"currency":"IDR"

},

"inquiryStatus":"00",

"inquiryReason":{

"english":"Success",

"indonesia":"Sukses"

},

"additionalInfo":{

"idApp":"TEST",

"info1":"info 1 harus diisi"

}

}

}

Error Response :

{

"responseCode": "4042414",

"responseMessage": "Paid Bill"

}

List of Error/Response Code

|

HTTP Status |

Service Code |

Case Code |

Response Message |

Status |

Mandatory |

|---|---|---|---|---|---|

|

200 |

24 |

00 |

Success |

Success |

M |

|

202 |

24 |

00 |

Request in Progress |

Failed |

O |

|

400 |

24 |

01 |

Bad Request |

Failed |

M |

|

400 |

24 |

01 |

Invalid Field Format {field name} |

Failed |

M |

|

400 |

24 |

02 |

Invalid Mandatory Field {field name} |

Failed |

M |

|

401 |

24 |

00 |

Unauthorized. [reason] |

Failed |

M |

|

401 |

24 |

01 |

Invalid Token (B2B) | Failed | M |

|

401 |

24 |

02 |

Invalid Customer Token |

Failed |

O |

|

401 |

24 |

03 |

Token Not Found (B2B) |

Failed |

O |

|

401 |

24 |

04 |

Customer Token Not Found |

Failed |

O |

|

401 |

73 |

00 |

Unauthorized. [reason] |

Failed |

O |

|

401 |

73 |

01 |

Invalid Token (B2B) |

Failed |

O |

|

401 |

73 |

02 |

Invalid Customer Token | Failed | O |

| 401 | 73 | 03 | Token Not Found (B2B) | Failed | O |

| 401 | 73 | 04 | Customer Token Not Found | Failed | O |

| 403 | 24 | 00 | Transaction Expired | Failed | O |

| 403 | 24 | 01 | Feature Not Allowed [Reason] | Failed | O |

| 403 | 24 | 02 | Exceeds Transaction Amount Limit | Failed | O |

| 403 | 24 | 03 | Suspected Fraud | Failed | O |

| 403 | 24 | 04 | Activity Count Limit Exceeded | Failed | O |

| 403 | 24 | 05 | Do Not Honor | Failed | O |

| 403 | 24 | 06 | Feature Not Allowed At This Time. [reason] | Failed | O |

| 403 | 24 | 07 | Card Blocked | Failed | O |

| 403 | 24 | 08 | Card Expired | Failed | O |

| 403 | 24 | 09 | Dormant Account | Failed | O |

| 403 | 24 | 10 | Need To Set Token Limit | Failed | O |

| 403 | 24 | 11 | OTP Blocked | Failed | O |

| 403 | 24 | 12 | OTP Lifetime Expired | Failed | O |

| 403 | 24 | 13 | OTP Sent To Cardholer | Failed | O |

| 403 | 24 | 14 | Insufficient Funds | Failed | O |

| 403 | 24 | 15 | Transaction Not Permitted.[reason] | Failed | O |

| 403 | 24 | 16 | Suspend Transaction | Failed | O |

| 403 | 24 | 17 | Token Limit Exceeded | Failed | O |

| 403 | 24 | 18 | Inactive Card/Account/Customer | Failed | O |

| 403 | 24 | 19 | Merchant Blacklisted | Failed | O |

| 403 | 24 | 20 | Merchant Limit Exceed | Failed | O |

| 403 | 24 | 21 | Set Limit Not Allowed | Failed | O |

| 403 | 24 | 22 | Token Limit Invalid | Failed | O |

| 403 | 24 | 23 | Account Limit Exceed | Failed | O |

| 404 | 24 | 00 | Invalid Transaction Status | Failed | O |

| 404 | 24 | 01 | Transaction Not Found | Failed | O |

| 404 | 24 | 02 | Invalid Routing | Failed | O |

| 404 | 24 | 03 | Bank Not Supported By Switch | Failed | O |

| 404 | 24 | 04 | Transaction Cancelled | Failed | O |

| 404 | 24 | 05 | Merchant Is Not Registered For Card Registration Services | Failed | O |

| 404 | 24 | 06 | Need To Request OTP | Failed | O |

| 404 | 24 | 07 | Journey Not Found | Failed | O |

| 404 | 24 | 08 | Invalid Merchant | Failed | O |

| 404 | 24 | 09 | No Issuer | Failed | O |

| 404 | 24 | 10 | Invalid API Transition | Failed | O |

| 404 | 24 | 11 | Invalid Card/Account/Customer [info]/Virtual Account | Failed | O |

| 404 | 24 | 12 | Invalid Bill/Virtual Account [Reason] | Failed | M |

| 404 | 24 | 13 | Invalid Amount | Failed | O |

| 404 | 24 | 14 | Paid Bill | Failed | M |

| 404 | 24 | 15 | Invalid OTP | Failed | O |

| 404 | 24 | 16 | Partner Not Found | Failed | O |

| 404 | 24 | 17 | Invalid Terminal | Failed | O |

| 404 | 24 | 18 | Inconsistent Request | Failed | O |

| 404 | 24 | 19 | Invalid Bill/Virtual Account | Failed | M |

| 405 | 24 | 00 | Requested Function Is Not Supported | Failed | O |

| 405 | 24 | 01 | Requested Opearation Is Not Allowed | Failed | O |

| 409 | 24 | 00 | Conflict | Failed | M |

| 409 | 24 | 01 | Duplicate partnerReferenceNo | Failed | O |

| 429 | 24 | 00 | Too Many Requests | Failed | O |

| 500 | 24 | 00 | General Error | Failed | M |

| 500 | 24 | 01 | Internal Server Error | Failed | O |

| 500 | 24 | 02 | External Server Error | Failed | O |

| 504 | 24 | 00 | Timeout | Failed | M |

Seluruh response error yang tidak tercantum dalam list response BRIAPI memiliki status pending/suspend dan perlu dilakukan pengecekan

B. Payment

Endpoint Description

Endpoint ini digunakan untuk menandai pembayaran VA ke mitra BRI

General Information

|

HTTP Method |

POST |

|---|---|

|

Path |

../{{version}}/transfer-va/payment |

|

Tipe Format |

JSON |

|

Authentication |

OAuth 2.0 with Access Token |

Request Structure

|

Field |

Data Type |

Format |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|---|

|

partnerServiceId |

String |

Numeric |

M |

8 |

Turunan dari X PARTNER ID, mirip dengan kode perusahaan, 8 digit left padding space. partnerServiceId + customerNo or virtualAccountNo |

____77777 |

|

customerNo |

String |

Numeric |

M |

13 Note: SNAPBI Length (20) |

Nomor Unik (hingga 20 digits). partnerServiceId + customerNo or virtualAccou ntNo |

0000000000001 |

|

virtualAccountNo |

String |

Numeric |

M |

28 |

partnerServiceId (8 digit left padding space) + customerNo (hingga 20 digits). partnerServiceId + |

___777770000000000001 |

|

virtualAccountName |

String |

Alphanumeric |

M |

255 |

Nama Pelanggan |

John Doe |

|

paidAmount |

Object |

|

M |

|

|

|

|

> value |

String |

Numeric |

M |

16,2 |

Jumlah transaksi. |

10001.00 |

|

>currency |

String |

Alphabet |

M |

3 |

Mata Uang |

IDR |

|

trxDateTime |

Date |

Numeric |

O |

25 |

Tanggal waktu sistem PJP internal dengan zona waktu, yang mengikuti standar ISO-8601 |

2021-11-25T22:56:31+07:00 |

|

channelCode |

Integer |

Numeric |

O |

4 |

Channel code berdasarkan ISO 18245 Channel code BRI mengacu pada: 1 : teller 2 : ATM 3 : IB/NBMB/Brilink Mobile 4 : SMSB 5 : CMS/IBIZ 6 : EDC 7 : RTGS 8 : OTHER 9 : API |

1 |

|

sourceBankCode |

String |

Numeric |

O |

3 |

Kode bank BRI. Format : 0002 |

002 |

|

trxId |

String |

Numeric |

C |

64 |

Identifier untuk transaksi. |

2132902068917559061 |

|

paymentRequestId |

String |

Alphanumeric |

M |

36 Note: SNAP BI Length (128)

|

Unique identifier. jika pembayaran datang dari proses Inquiry, nilai harus sama dengan inquiryRequestId |

e3bcb9a2-e253-40c6-aa77-d72cc138b744 |

|

hashedSourceAccountNo |

String |

Hash Base64 |

O |

32 |

nomor akun sumber di hash |

kmlm234k2nnsoebr997 |

|

additionalInfo |

Object |

|

O |

|

|

|

|

>passApp |

String |

Alphanumeric |

O |

64 |

kunci dari pihak ketiga untuk akses API |

b7aee423dc7489dfa868426e5c950c677925f3b9 |

|

>idApp |

String |

Alphanumeric |

O |

8 |

Bank identifier dari pihak ketiga untuk akses API |

TEST |

Response Structure

|

Field |

Data Type |

Format |

Mandatory |

Length |

Description |

Example |

|---|---|---|---|---|---|---|

|

responseCode |

String |

Numeric |

M |

7 |

Response code |

2002500 |

|

responseMessage |

String |

|

M |

150 |

Response description |

Successful |

|

virtualAccountData |

Object |

|

M |

|

Detail data akun vertual |

|

|

>partnerServiceId |

String |

Numeric |

M |

8 |

Turunan dari f X- PARTNER- ID , mirip dengan kode perusahaan. partnerServiceId + customerNo atau virtualAccountNo |

___77777 |

|

>customerNo |

String |

Numeric |

M |

13 Note: SNAP BI length (20) |

Nomor unik (hingaa 20 digit). partnerServiceId + customerNo atau virtualAccountNo |

0000000000001 |

|

>virtualAccountNo |

String |

Numeric |

M |

28 |

Nomor BRIVA. Format : partnerServiceId + customerNo |

___777770000000000001 |

|

>virtualAccountName |

String |

Alphanumeric |

M |

255 |

Nama Pelanggan |

John Doe |

|

>paymentRequestId |

String |

Alphanumeric |

M |

36 Note: SNAP BI length (128) |

Dari permintaan pembayaran |

e3bcb9a2-e253-40c6-aa77-d72cc138b744 |

|

>paidAmount |

Object |

|

O |

|

|

|

|

>>value |

String |

Numeric |

M |

16,2 |

Jumlah transaksi dari permintaan pembayaran |

10001.00 |

|

>>currency |

String |

Alphabet |

M |

3 |

Mata Uang |

IDR |

|

>paymentFlagStatus |

Object |

Numeric |

O |

2 |

Status for Payment Flag from Partner 00 = Success 01 = Reject 02 = Timeout |

00 |

|

>paymentFlagReason |

String |

|

O |

|

|

|

|

>>english |

String |

Alphabet |

O |

|

|

Success |

|

>>indonesia |

String |

Alphabet |

O |

|

|

Sukses |

|

additionalInfo |

Object |

|

O |

|

|

|

|

>passApp |

String |

Alphanumeric |

O |

64 |

Kunci dari pihak ketiga untuk mengakses API |

b7aee423dc7489dfa868426e5c950c677925f3b9 |

|

>idApp |

String |

Alphanumeric |

M |

8 |

Bank identifier dari pihak ketiga untuk mengakses API |

TEST |

|

>info1 |

String |

Alphanumeric |

O |

20 |

Catatan dari mitra |

info 1 diisi |

Request & Response Payload Sample

Request

{

"partnerServiceId":" 77777",

"customerNo":"0000000000001",

"virtualAccountNo":" 777770000000000001",

"virtualAccountName":"John Doe",

"paidAmount":{

"value":"10001.00",

"currency":"IDR"

},

"trxDateTime":"2021-11-25T22:56:31+07:00",

"channelCode":1,

"sourceBankCode":"002",

"trxId":"2132902068917559061",

"paymentRequestId":"e3bcb9a2-e253-40c6-aa77-d72cc138b744",

"hashedSourceAccountNo":"kmlm234k2nnsoebr997",

"additionalInfo":{

"idApp":"TEST",

"passApp":"b7aee423dc7489dfa868426e5c950c677925f3b9"

}

}

Normal Response :

{

"responseCode":"2002500",

"responseMessage":"Successful",

"virtualAccountData":{

"partnerServiceId":" 77777",

"customerNo":"0000000000001",

"virtualAccountNo":" 777770000000000001",

"virtualAccountName":"John Doe",

"paymentRequestId":"e3bcb9a2-e253-40c6-aa77-d72cc138b744",

"paidAmount":{

"value":"10001.00",

"currency":"IDR"

},

"paymentFlagStatus":"00",

"paymentFlagReason":{

"english":"Success",

"indonesia":"Sukses"

}

},

"additionalInfo":{

"idApp":"TEST",

"passApp":"b7aee423dc7489dfa868426e5c950c677925f3b9",

"info1":"info 1 diisi"

}

}

Error Response :

{

"responseCode": "4042512",

"responseMessage": "Invalid Bill/Virtual Account [Reason]"

}

List of Error/Response Code

|

HTTP Status |

Service Code |

Case Code |

Response Message |

Status |

Mandatory |

|---|---|---|---|---|---|

|

200 |

25 |

00 |

Success |

Successful |

M |

|

202 |

25 |

00 |

Request In Progress |

Reversal |

O |

|

400 |

25 |

00 |

Bad Request |

Reversal |

M |

|

400 |

25 |

01 |

Invalid Field Format {field name} |

Reversal |

M |

|

400 |

25 |

02 |

Invalid Mandatory Field {field name} |

Reversal |

M |

|

401 |

25 |

00 |

Unauthorized. [reason] |

Reversal |

M |

|

401 |

25 |

01 |

Invalid Token (B2B) |

Reversal |

M |

|

401 |

25 |

02 |

Invalid Customer Token |

Reversal |

O |

|

401 |

25 |

03 |

Token Not Found (B2B) |

Reversal |

O |

|

401 |

25 |

04 |

Customer Token Not Found |

Reversal |

O |

|

403 |

25 |

00 |

Transaction Expired |

Reversal |

O |

|

403 |

25 |

01 |

Feature Not Allowed [Reason] |

Reversal |

O |

|

403 |

25 |

02 |

Exceeds Transaction Amount Limit |

Reversal |

O |

| 403 | 25 | 03 | Suspected Fraud | Reversal | O |

| 403 | 25 | 04 | Activity Count Limit Exceeded | Reversal | O |

| 403 | 25 | 05 | Do Not Honor | Reversal | O |

| 403 | 25 | 06 | Feature Not Allowed At This Time. [reason] | Reversal | O |

| 403 | 25 | 07 | Card Blocked | Reversal | O |

| 403 | 25 | 08 | Card Expired | Reversal | O |

| 403 | 25 | 09 | Dormant Account | Reversal | O |

| 403 | 25 | 10 | Need To Set Token Limit | Reversal | O |

| 403 | 25 | 11 | OTP Blocked | Reversal | O |

| 403 | 25 | 12 | OTP Lifetime Expired | Reversal | O |

| 403 | 25 | 13 | OTP Sent To Cardholer | Reversal | O |

| 403 | 25 | 14 | Insufficient Funds | Reversal | O |

| 403 | 25 | 15 | Transaction Not Permitted.[reason] | Reversal | O |

| 403 | 25 | 16 | Suspend Transaction | Reversal | O |

| 403 | 25 | 17 | Token Limit Exceeded | Reversal | O |

| 403 | 25 | 18 | Inactive Card/Account/Customer | Reversal | O |

| 403 | 25 | 19 | Merchant Blacklisted | Reversal | O |

| 403 | 25 | 20 | Merchant Limit Exceed | Reversal | O |

| 403 | 25 | 21 | Set Limit Not Allowed | Reversal | O |

| 403 | 25 | 22 | Token Limit Invalid | Reversal | O |

| 403 | 25 | 23 | Account Limit Exceed | Reversal | O |

| 404 | 25 | 00 | Invalid Transaction Status | Reversal | O |

| 404 | 25 | 01 | Transaction Not Found | Reversal | O |

| 404 | 25 | 02 | Invalid Routing | Reversal | O |

| 404 | 25 | 03 | Bank Not Supported By Switch | Reversal | O |

| 404 | 25 | 04 | Transaction Cancelled | Reversal | O |

| 404 | 25 | 05 | Merchant Is Not Registered For Card Registration Services | Reversal | O |

| 404 | 25 | 06 | Need To Request OTP | Reversal | O |

| 404 | 25 | 07 | Journey Not Found | Reversal | O |

| 404 | 25 | 08 | Invalid Merchant | Reversal | O |

| 404 | 25 | 09 | No Issuer | Reversal | O |

| 404 | 25 | 10 | Invalid API Transition | Reversal | O |

| 404 | 25 | 11 | Invalid Card/Account/Customer [info]/Virtual Account | Reversal | O |

| 404 | 25 | 12 | Invalid Bill/Virtual Account [Reason] | Reversal | M |

| 404 | 25 | 13 | Invalid Amount | Reversal | M |

| 404 | 25 | 14 | Paid Bill | Reversal | M |

| 404 | 25 | 15 | Invalid OTP | Reversal | O |

| 404 | 25 | 16 | Partner Not Found | Reversal | O |

| 404 | 25 | 17 | Invalid Terminal | Reversal | O |

| 404 | 25 | 18 | Inconsistent Request | Reversal | O |

| 404 | 25 | 19 | Invalid Bill/Virtual Account | Reversal | M |

| 405 | 25 | 00 | Requested Function Is Not Supported | Reversal | O |

| 405 | 25 | 01 | Requested Opearation Is Not Allowed | Reversal | O |

| 409 | 25 | 00 | Conflict | Reversal | M |

| 409 | 25 | 01 | Duplicate partnerReferenceNo | Reversal | O |

| 429 | 25 | 00 | Too Many Requests | Suspend | O |

| 500 | 25 | 00 | General Error | Suspend | M |

| 500 | 25 | 01 | Internal Server Error | Suspend | O |

| 500 | 25 | 02 | External Server Error | Suspend | O |

| 504 | 25 | 00 | Timeout | Suspend | M |

Seluruh response error yang tidak tercantum dalam list response BRIAPI memiliki status pending/suspend dan perlu dilakukan pengecekan